Recent advancements in artificial intelligence have turned the world on its head.

Many industries are scrambling to understand the ramifications of this new era of machine learning, production, and interaction.

As someone deeply rooted in the tech field, I can tell you that AI adoption is accelerating.

Nothing will stop it.

We’ll soon be tasking AI agents to automate our lives. They will handle complex, tedious, and repetitive tasks we dislike.

AI agents — friends or foes?

Traditional financial institutions will keep hard blocks in place to ensure that machines cannot access funds and make unchecked transactions.

That’s good, right? We don’t want to wake up and find our bank accounts emptied.

Well, the checks they use are like a wall, not a door. You cannot control whether machines should or shouldn’t have access to certain information.

Many sites use captchas to stop scripts from scraping card details for security. Many payment processors provide APIs. However, developers must still program AI agents to manage payments for various services.

Sites and apps denying all bots access is a problem.

It hampers the development of efficient automation. These are automations that can hugely benefit people.

Imagine having a robotic personal assistant that did all your online administration (including purchases). They could find the best deals and most beneficial services in seconds.

The traditional financial infrastructure is not suited for programmable payments.

To ensure controlled use of AI payments, we need to use cryptographic signatures, and that’s not possible with Euros or dollars.

How would AI money work?

There are many ways in which AI could be employed in the payments ecosystem. For now, let’s focus on one that’s possible today — AI agents that act as personal assistants.

These AI systems need reasoning abilities to make smart decisions — not just chat, but act on your behalf.

Recent AI models have improved reasoning skills:

o1 (September 2024, OpenAI)

Claude 3.5 / 3.7 (2024, Anthropic)

Gemini 2.0 (2024, Google)

These models allow AI agents to plan, analyze, and take action, not just respond to questions. We’ve seen many schemes, standards, and protocols allowing LLM-powered tools to access other data sources, tools, and services.

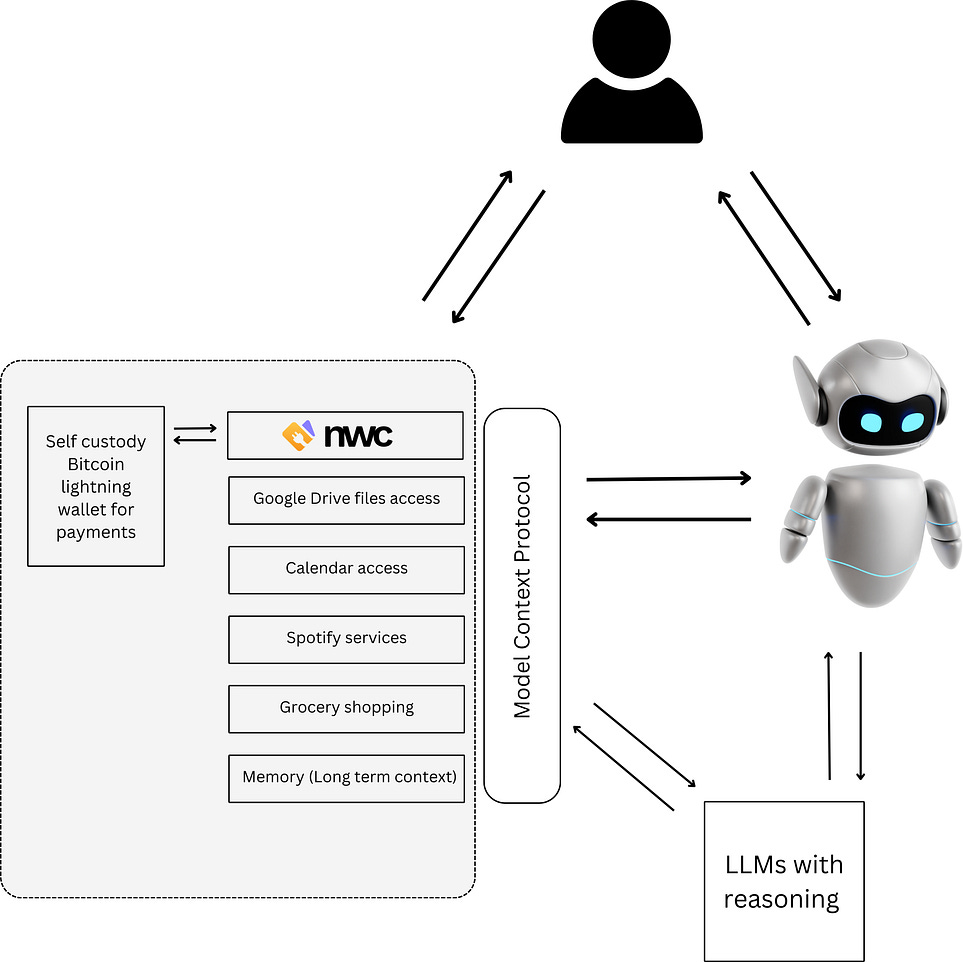

One such initiative is the Model Context Protocol (MCP), an open standard from Anthropic. It provides a standard interface. This lets any LLM-powered tool connect easily to different data or service backends.

If you haven’t already, watch this demo video before getting started:

It is a demo of purchasing an eSIM by an agent with a Euro balance using Bitcoin as a medium of value transfer.

Let’s break the video down:

With Bitcoin, you can move value over the internet without any third party. However, there are several challenges when using Bitcoin for AI-driven transactions, such as:

Controlled access: Providing private keys to your AI is not good safety protocol.

Faster payments: Bitcoin payments take at least 10 minutes to confirm on the blockchain.

Secured access and ways to revoke access.

One of the solutions to this is The Lightning Network — a second-layer solution for Bitcoin. It allows fast and low-cost transactions by setting up off-chain payment channels. It reduces congestion on the main blockchain while maintaining decentralization and security.

Lightning wallets have been evolving. Many custodial lightning wallets provide reliable and seamless payments. Recently, there has been advancement in the self-custody lightning wallet space. Many excellent self-custody Lightning wallets are now available. They simplify Lightning channel management and make payments easy.

In order for AI to be able to make payments, we must still solve the control access issue. That’s where Nostr comes into the picture:

Nostr Wallet Connect (NWC) is a protocol that enables secure, programmable access to Lightning wallets using Nostr’s decentralized messaging system.

How Nostr Wallet Connect works:

Now, AI agents can use NWC for secure and fast payments to merchants, with controlled and custom access.

Enhancing NWC with MPC for Better Control:

Using an MPC service that builds on NWC will add a layer of programmability for better control over access to funds. The architecture after doing that looks like this:

Nostr Wallet Connect services via MPC servers

This seems ideal for AI agents to pay on our behalf. But we are not there yet. There is one final problem to solve.

Adoption: AI vs. Bitcoin

Only a small percentage of the population hold Bitcoin. It’s certainly not a common medium of exchange yet. We see many merchants and businesses around the world accepting Bitcoin, but if you compare it to AI adoption, it is much slower.

Bringin: Connecting Bitcoin and Banking

I started Bringin to solve the problem I faced. Spending Bitcoin or using it to buy tangible value was not easy for the same reason: no one accepts Bitcoin. It took days to receive Euros, and banks often flagged it as a fraudulent trader, making it more tedious.

With Bringin today, users can swap Bitcoin in their lightning wallet for Euros in their bank accounts in under a minute. This speed is unprecedented. Users can also get Bitcoin to their wallet from euros in no time, anytime.

This is powerful: users can hold euros in their vIBAN (virtual International Bank Account Number). They can also let AI agents make payments with lightning invoices. For this, we need to expose the Bringin services via the MCP.

At Bringin, we support open protocols that communities can use together so everyone can benefit from it. Bringin services use the latest open protocols, such as Nostr Wallet Connect and LNURL. This makes it easy for anyone to link their Bitcoin wallet to a Euro account. AI agents can only use the NWC services through MCP to access Euros on Bringin IBAN for payments. This means all the goodness of controlled access to funds and users need not hold Bitcoin.

Bringin IBAN works with any Lightning wallet. Users are free to choose the lightning wallet of their choice. For new Bitcoin users, we will offer a ready-to-use self-custody lightning wallet that works with NWC.

Merchant Adoption and the Future of AI Payments

AI paying with Bitcoin is only possible if Merchants accept Bitcoin. BitPay, Coingate, BTCPayServer, and OpenNode are some popular payment companies. They help businesses to accept Bitcoin payments, and many other companies are now emerging, allowing merchants to accept Bitcoin and Lightning Payments.

Bringin works with payment processors to offer quick off-ramping to fiat accounts. This helps merchants accept Bitcoin payments with minimal effort. They don’t have to stress about Bitcoin price changes or deal with exchanges.

Building the Future of AI-Driven Payments

The days for AI agents to take up critical yet tedious work from our platform are not far away.

LLMs are improving their reasoning capabilities.

MCP was recently announced. We expect more services for AI agents to follow.

Lightning adoption is progressing at a steady pace.

NWC is getting more advanced. Also, more Bitcoin Lightning wallets are joining the ecosystem.

Merchant payment solutions for accepting Bitcoin payments are only growing.

Innovative solutions like Bringin are helping speed up Bitcoin adoption. They push products and services to make Bitcoin a common way to pay, especially for AI, until Bitcoin payments become more widely used.

My prediction is that automation and transactions will become far less labor-intensive for consumers.

But that means that developers and companies managing the protocols and security of fintech products will need to innovate and release new solutions. We must remember to follow the principle of ensuring secure access to systems. Don’t trust; verify.

That way, AI won’t take control of money away from us. We can use agents and new solutions to improve our purchase decisions and free up time.

Introducing BringinLabs

With this demo, we are also launching BringinLabs — a space for any innovators in the Bitcoin and/or AI space to come and build something innovative.

We plan to host hackathons, provide bounties, help with content and promotion, and a lot more support.

***

Thanks for reading to the end.

I’m looking forward to your thoughts on this one.

How do you think AI will affect how we use money?